Flexible Savings Solutions with Flexi Hela

Get 100k Life Cover Benefit with 700 bob deposit only!

mTek has partnered with Sanlam Insurance to provide Flexi Hela, a flexible savings solution that allows you to save while benefitting from life cover for you and your family. It has an open-ended term so you can enjoy the benefits of the policy and continue to save, as long as your policy remains active. You will have immediate access to your savings value with no withdrawal or surrender penalties. You can also make various changes to your policy, such as increasing and reducing your savings contribution and amending lives and benefits covered on the policy, anytime you want.

Product Features

Savings contributions

- You can choose to invest any amount, which will grow at the declared interest rate.

- You can also make changes to your savings contribution anytime you want. Your savings contributions will grow at the declared interest rate over time.

- Lastly, you are allowed to withdraw any amount up to the full value of your savings at any time, and there are no penalties for such withdrawals.

The interest that you earn on your savings balance will be the prevailing interest rate determined by us, from time to time during the life of this policy, and is subject to change. Changes in the interest rate will only affect the future growth of your savings.

Life Cover

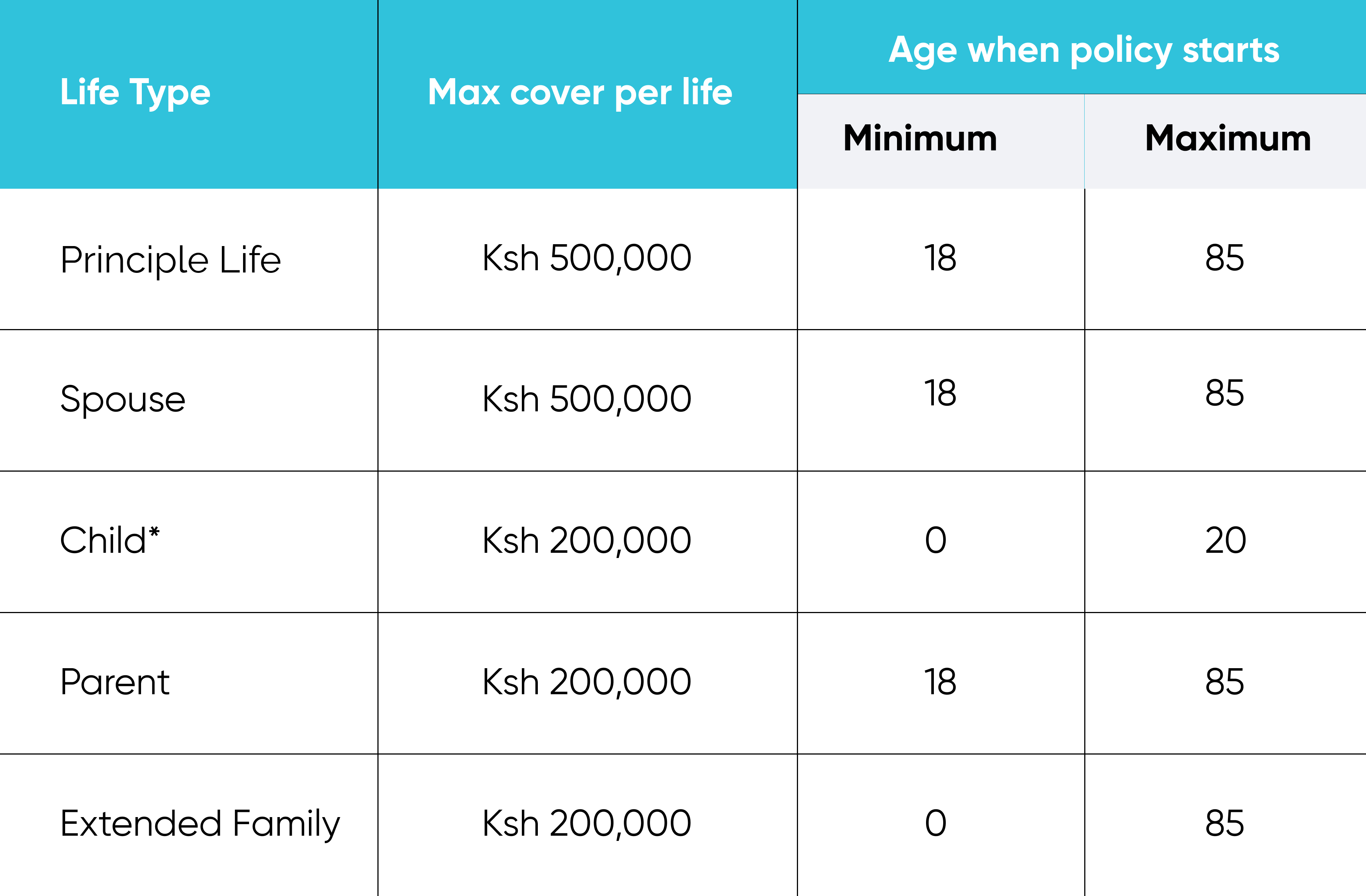

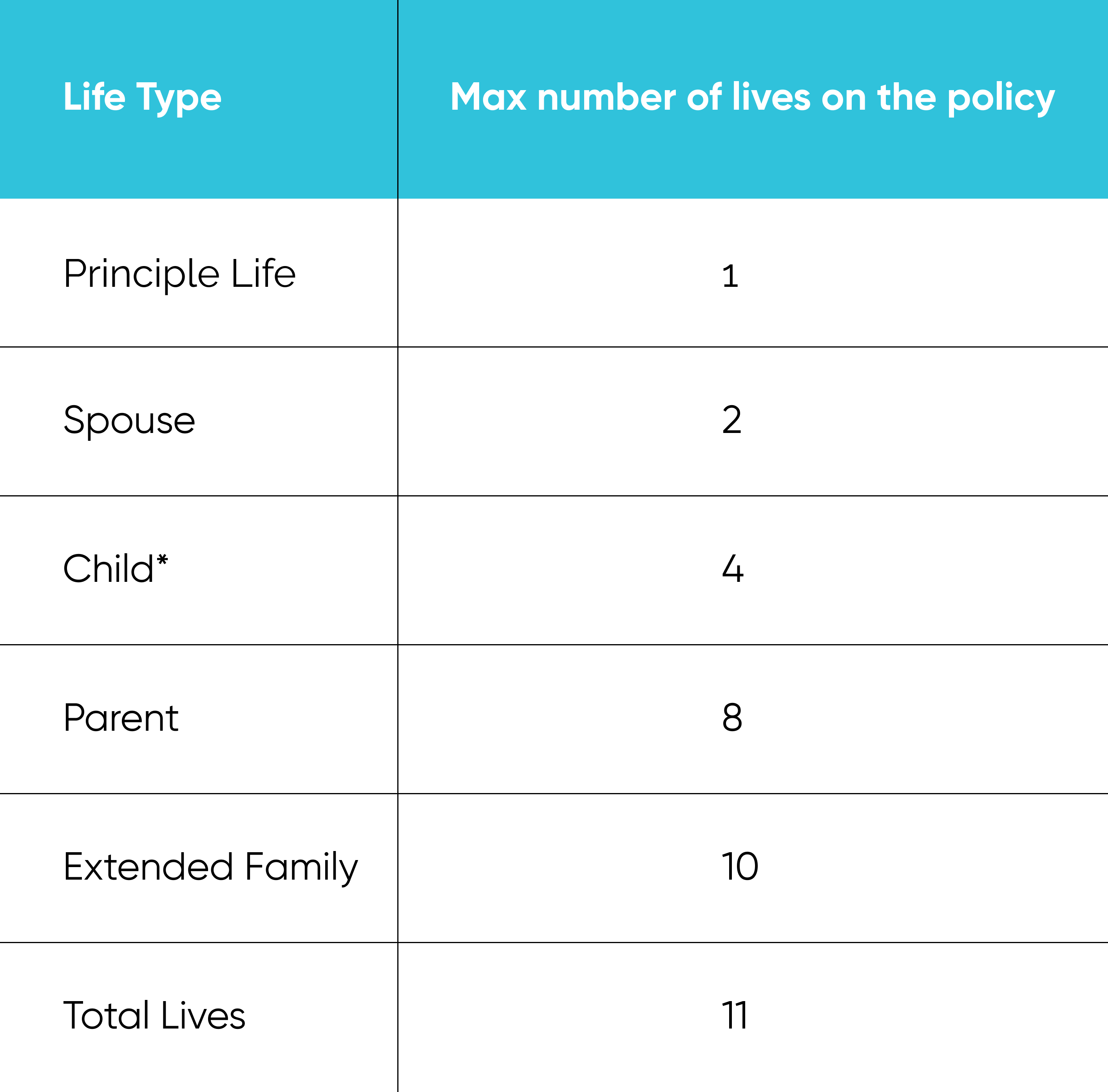

The lives that you can cover on the policy are shown below.

- Children below the age of 10 years will be covered to a maximum of Kshs.100,000.

- Death claims that arise due to criminal acts, suicide within two years of the policy start date or cover start date for any life assured, and war other than passive war (whether war is declared or not) in respect of all National Defense Forces, will not be paid.

Waiting Period

The waiting period is the period after the start date of the policy, alterations to the policy or reinstatement of the policy where claims due to natural death will not be paid. A six-month waiting period will apply.

Loans

No loans will be allowed under this policy.

Frequently Asked Questions

1. How long can you keep the policy?

The policy has an open-ended term. You can keep the policy for as long as you want, as long as it remains active. You can keep paying premiums and the assured lives will remain covered on the policy until:

- The policy lapses

- You submit a request for cancellation

- The principal life assured dies

- We cancel your policy for any reason including, but not limited to, suspected fraud or misrepresentation

If any of the events mentioned above happen, the policy will not be active anymore. Your premiums or contributions at such an instance will cease, and we shall not pay any further claims.

2. How long can family members be covered by the policy?

As long as the policy is active, all lives can remain covered, subject to their premiums being paid. Cover for children ceases on their 20th birthday. Thereafter, you will be able to add them as extended family.

3. How long can you save on the policy?

As long as the policy is active, you can continue contributing to your savings. If you don’t pay a risk premium when due, we will deduct the risk premium from your savings value.

4. What if you want to change your policy?

If you want to make changes to your policy, you can simply contact us at [email protected] or call us on 0800 720 137 for FREE, to be guided.

5. How can your policy lapse?

You can cancel your policy at any time should you wish to. Simply let us know of your decision. Your cover will cease, and we will pay you your savings value. If you do not pay your risk premium on time, the risk premium will be deducted from your savings value. If you do not pay your risk premium on time and do not have enough in your savings value to fund your risk premium, your policy will remain in force for one calendar month which is called the grace period.

During the grace period, death benefits remain in force. If the insured dies during the grace period, we will deduct the amount of any unpaid premiums from the death benefit payable. Should your risk premium remain unpaid, your policy will lapse after the grace period.s long as the policy is active, you can continue contributing to your savings. If you don’t pay a risk premium when due, we will deduct the risk premium from your savings value.

6. How do you get your lapsed policy back to being active?

You can reinstate your policy at any time for up to twelve months from the date of lapse by contacting us and paying the premiums from the date of reinstatement, subject to our acceptance. The waiting period will apply from the date of reinstatement.

7. How do you make a claim?

Once you are logged in on your mTek app, go to your purchased policies and select your Life Cover, then proceed to Make a Claim.

For all death claims, we will need:

- The completed claim application form or written application signed by claimant with the following required documents:

- Policy document

- Certified true copy of medical certificate of cause of death (death certificate). This should be done by a commissioner of oaths or a court of competent jurisdiction in Kenya.

- Police report for accidental death only

- Proof of age of deceased life assured if the identity card was not provided prior to death

- Original or certified true copy of photo identity card of the policyholder (National ID/Passport)

- Certified copy of photo identity card of the claimant (National ID/Passport)

- Copy of the claimant’s bank statement showing the account holder’s name, bank account number, branch name and code of the claimant

8. Is there a cooling off period?

As the policyholder, you have a period of 30 days following delivery of the policy document to review and evaluate the policy to ensure that this is the right policy for you. During the cooling off period, you can cancel the policy and receive a refund of all premiums paid.